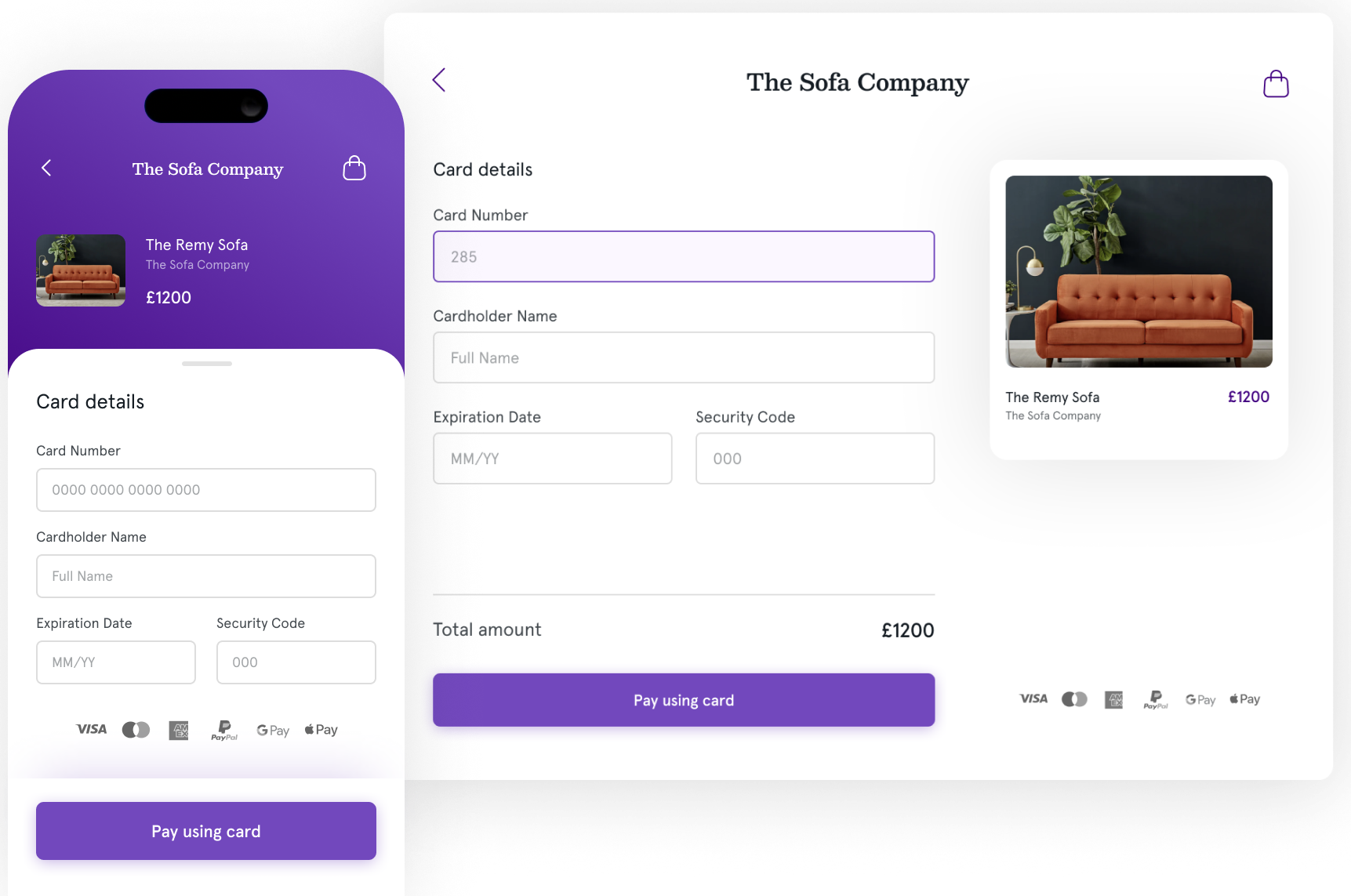

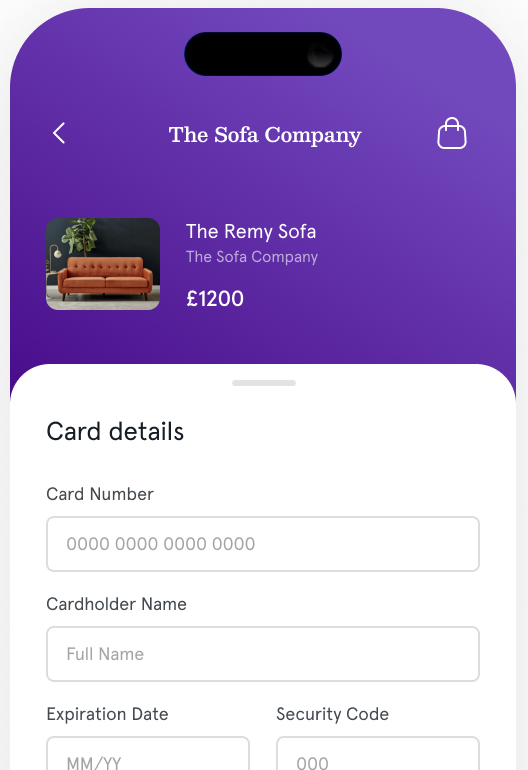

Perfecting customer experiences with Acquired.com

"We wanted to work with a payments partner that we could grow alongside and would take the time to truly learn about and understand our business and our customers. We have received amazing support from the Cashflows team,..."

75%

Reduction in time to decision for application processing.